- Office Directory

- Hotline Numbers

COMMERCIAL ACTIVITIES

Typical of cities in metropolitan areas, Mandaluyong has its own share of commercial strips and a central business district (Map 40).

The former, comprising mostly of banks (Map ~ Financial Institutions), offices and service establishments, stretch along public transport routes thereby serving both local consumers and passers-by from the neighboring localities.

Major commercial strips of the city include the stretch of Boni Avenue, Shaw Boulevard, Libertad-Sierra Madre area, Kalentong, San Francisco, part of Martinez, Sgt. Bumatay towards Barangka Drive and Pinatubo towards EDSA.

The city’s Central Business District on the eastern portion of the city is concentrated in the EDSA-Shaw-Pioneer Quadrangle.

Adjacent to the central business district is the High Density Commercial area comprising of establishments such as the Megamall, Shangri-La, Podium and the San Miguel Corporation headquarters.

The traditional neighborhood center, on the other hand, is replaced by groceries and convenience stores (Map 42), wet and dry markets (Map 43), sari-sari stores, medical and dental clinics, amusement places and other personal services dominating almost all internal roads in the city.

INDUSTRIAL ACTIVITIES

These activities are mostly concentrated within the EDSA-Shaw-Pioneer area and along Pasig River.

Although prominent in the manufacture of foods, medicines and laboratory equipment, these industries are gradually declining in number, opting to relocate in newly-developed industrial zones outside Metropolitan Manila.

In the Pasig River area, particularly in Barangays Namayan and Mabini J. Rizal, areas formerly industrial are now the sites for residential subdivisions and townhouses.

In the EDSA-Shaw-Pioneer area, the transformation is toward a more economically profitable and globally competitive commercial activity.

GROWTH RATE

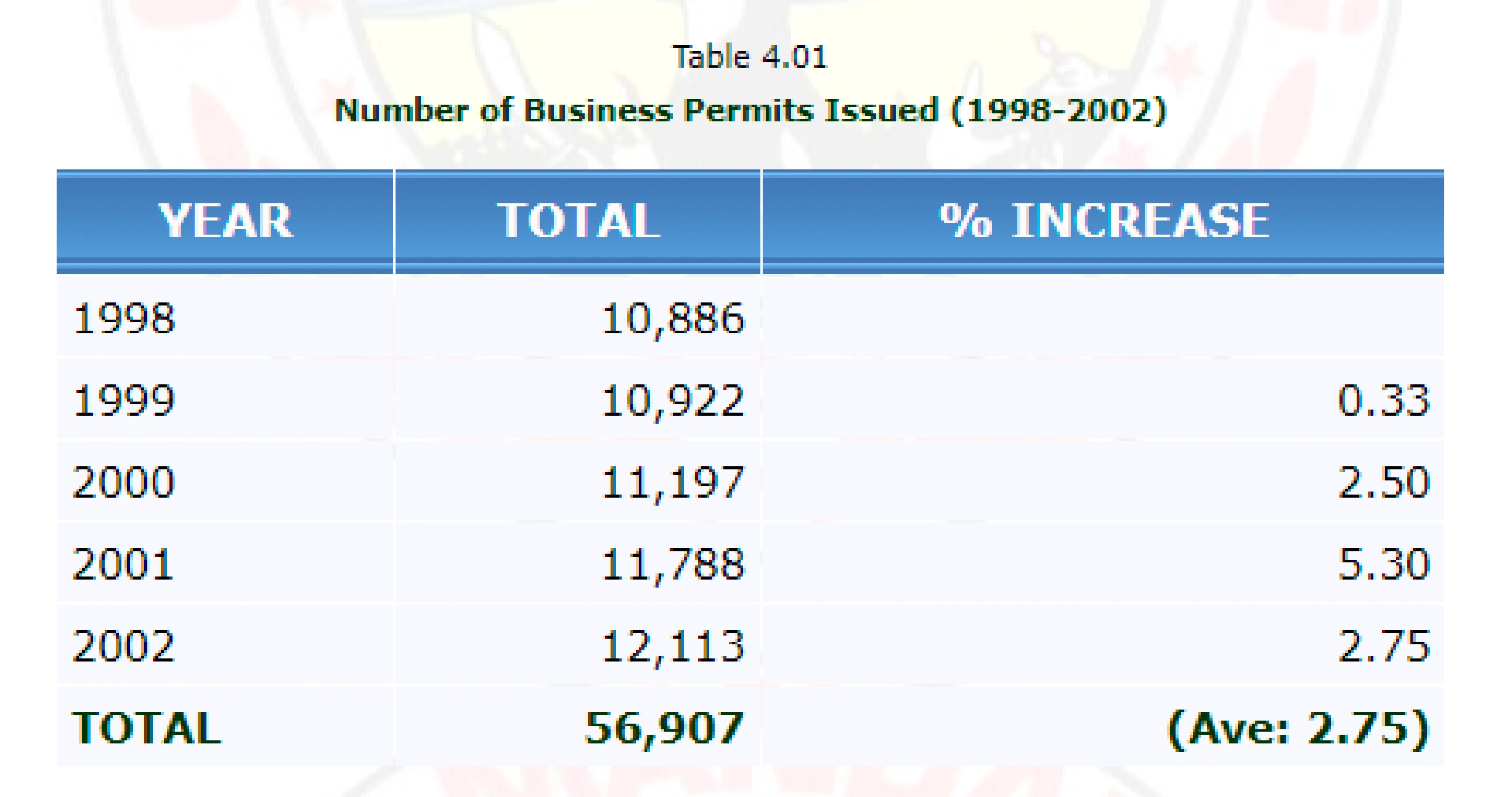

Given the above situation, it is reasonable that a comparison of the establishments in year 2000 and in 1990, counted at 11,177 and 10,658, respectively, yields a very low rate of increase of 4.9 percent. During the past five years, there is a slow but steady increase in business permits issued, averaging 2.72 percent as shown in Table 4.01.

As further manifested in Table 4.02, this is merely due to the shift in the nature of activities and not from any negative factors that may affect business development in the city.

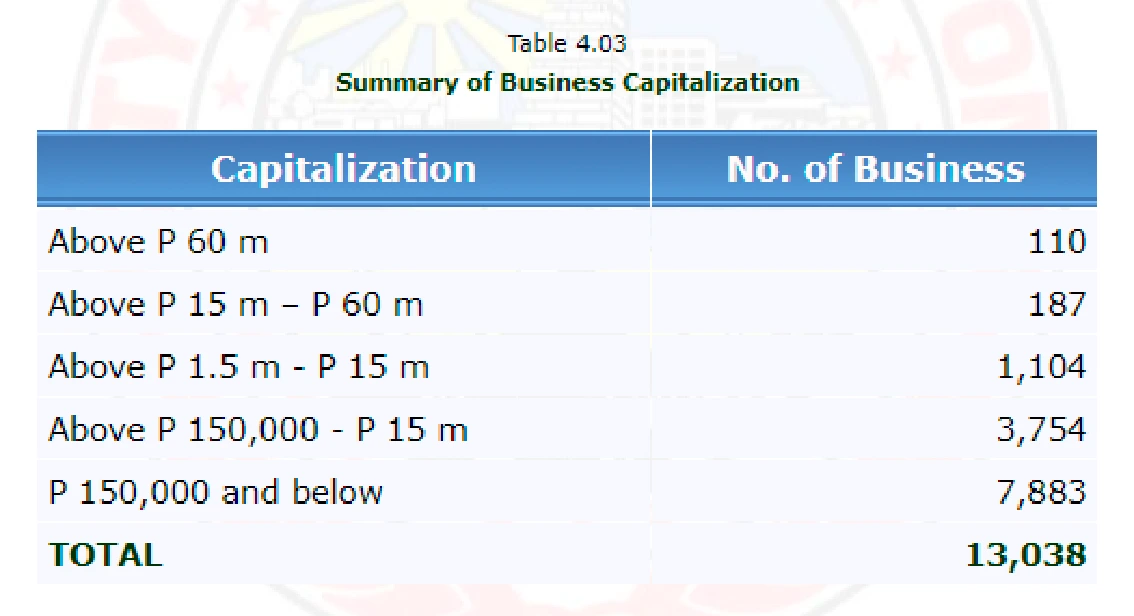

A great number of establishments consist of retailers and wholesalers which implies that the city’s economy is mostly pedalled by small-scale enterprises with capitalization below P 150,000.00, as manifested in Table 4.03.

However, it is expected that the city development plan which provides business incentives and higher commercial density will attract more investors in the years to come.

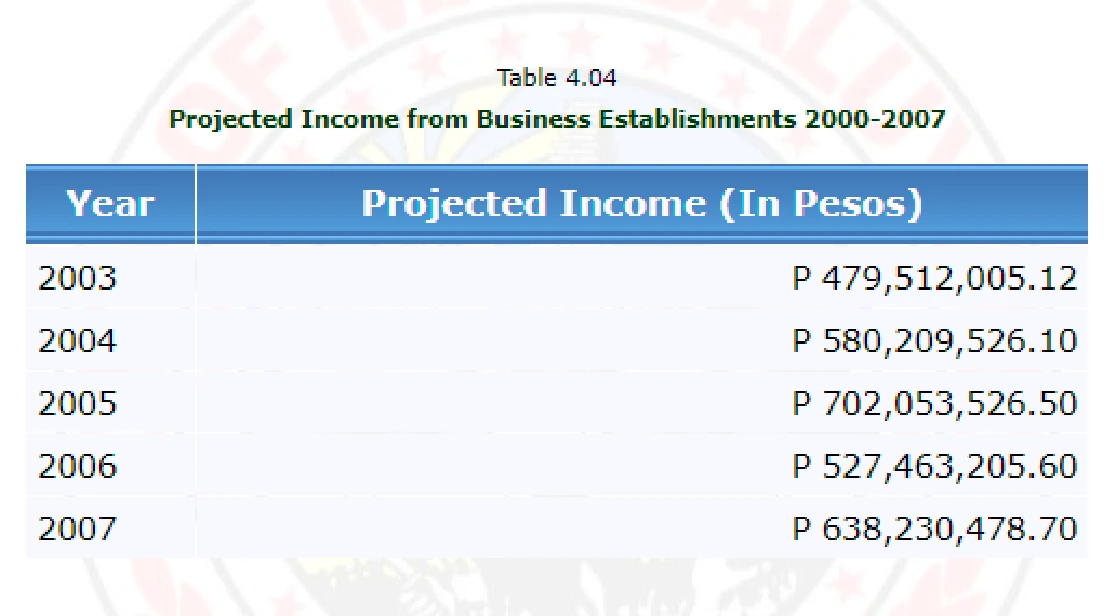

The city’s Business Permits and License Office (BPLO) has projected income from these business establishments to reach P638 million by year 2007 (Table 4.04). This is slowly being realized with the upsurge of investments especially in the development of the Edsa-Pioneer area into a major economic zone that could generate income and propel further growth and development in the entire city.

INVESTMENT POTENTIAL

If the main criterion for a successful business is location supplemented by sound business support policies and excellent peace and order situation, Mandaluyong City is rated competitively with other prime areas in Metro Manila.

For instance, there is a good potential in local market as indicated by the rising urban productivity despite increasing population projection. A comparative analysis of the number of households and household incomes at the city and national levels and the GNP yielded a city product per capita increasing by over 30% in 1997 from 1994 figures as shown in Table 4.05.

One consequence is the rising demand for commercial space resulting to rising unit cost of prime commercial land in the city. Similarly, the trend is increasing for unit cost of prime rental per month, while operating costs and statutory charges are dependent on capitalization and floor area occupied by each activity. By 1999, for a 36 sq. meter of rented space, the average cost of doing business in the city is as low as P 39,000.00 per month.

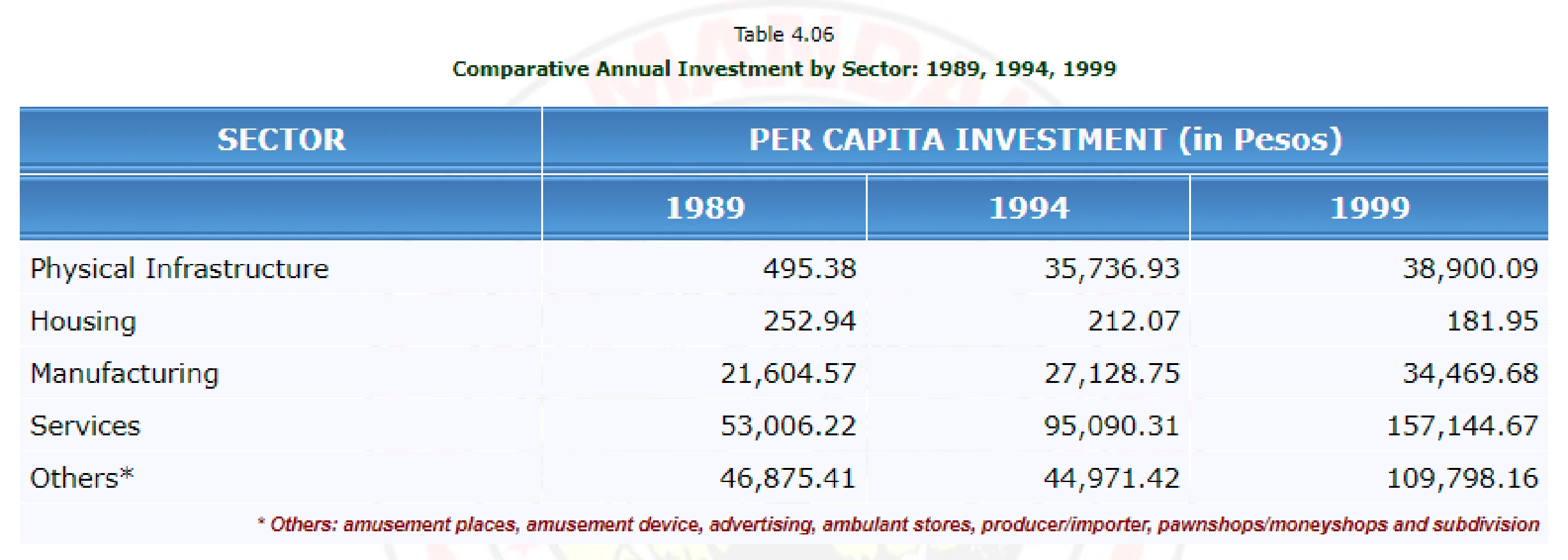

Moreover, as can be seen in Table 4.06, investment performances of the five major sectors per capita continuously increase based on five-year intervals while housing sector decreases due to limitation of vacant lands for housing development. Investments in the manufacturing industry show a modest but steady increase despite the shift in the economy to more service-oriented activities. Consequently, there are significant increases in the service industry and other activities ranging from 65% to 144%.

To further illustrate the growing confidence of investors in the city’s economy, Mandaluyong is now host to two (2) major corporate headquarters with annual turnovers of over $100 M (P 5.15 B) and another eight (8) top establishments with annual turnovers ranging from $26 M (P 1.34 B) to close to $100M.

It is worth noting, that in conjunction to the influx of investments is the overwhelming increase in assessed values of real property in the city. Despite having constant land area coverage and minimal land tax rate increases, real property assessment values skyrocketed to as high as 451.29% in a span of ten years from 1988 to 1998 and another 55.02% five years hence in year 2003 (see Table 4.07). These can be attributed to the magnitude of structural improvements not only on prime lots but also at random parts of the city where mixed developments of residential and office/commercial condominium up to seven (7) storeys in height are allowable.

New investments that will soon redefine the city skyline are listed in Table 4.08.

REGULATORY MEASURES

To regulate business establishments and facilitate transactions for business permits, taxes and clearances, the city government passed the following legislations:

-Revenue Code Ordinance

-Ordinances in License Plates/Stickers, CGL Insurance

-Regulations & Restrictions in Amusement and Fun Establishments

-Zoning Ordinance

INFORMAL SECTOR

In response to the strengthening of global advocacy towards full protection and recognition of the rights of workers in the informal sector, the city government created the City Informal Sector Office through Executive Order 02 Series 2002 to carry out the following objectives:

-To spearhead organization of IS workers’ associations

-To facilitate regulation of IS activities

-To develop and maintain a comprehensive IS database

-To coordinate forums, dialogues between IS groups and LGU officials

-To promote importance of social protection for workers

-To ensure access to skills development and enhancement training programs

-To facilitate access to market and employment

-To facilitate development and improvement of IS support infrastructures and facilities e.g. tricycle terminals, market stalls

-To provide access to social protection, investments and credit

-Zoning Ordinance w/c serves as basis for the issuance of Locational Clearance.

Expected Impacts/Benefits:

-Augmented coverage of BPLO targets for a more efficient registration of business and industrial establishments

-Estimation of IS contributions to the economy

-Increased participation to formal social security schemes

-Accreditation of IS organizations with the IS Office

-Increased productivity/ entrepre-neurial spirit

-Availability of alternative credit options, discouraging IS workers from accessing/resorting to traditional/ illegal loan schemes

-Availability of alternative social security schemes.